venmo tax reporting limit

If youre using a business profile on Venmo visit this article for more information on tax reporting. Venmo PayPal and Zelle.

Does The Irs Want To Tax Your Venmo Not Exactly

Open Venmo and log in to your account.

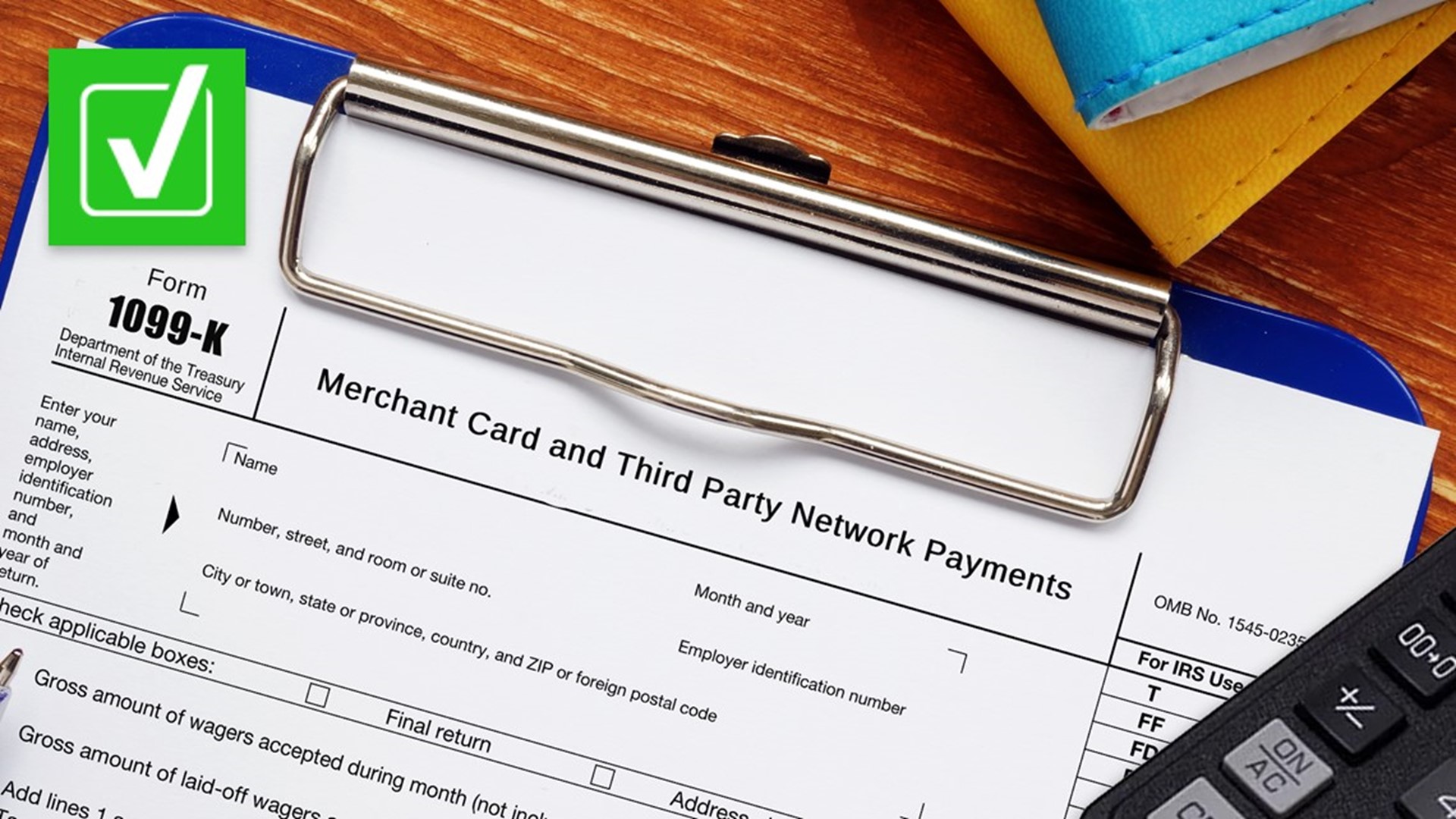

. Next tap on the gear icon in the top right corner of the. Payment app providers will have to start reporting to the IRS a users business transactions if in aggregate they total 600 or more for the year. Government passed legislation for 2022 as part of the American Rescue Plan Act that forces online payment platforms like Venmo PayPal Stripe and Square to report.

Jan 25 2022 157 PM. This new rule wont affect 2021 federal tax returns but now. By Tim Fitzsimons.

Taxes and Information Reporting Our fees do not include any taxes levies duties or similar governmental assessments of any nature including for example value-added sales. For the 2021 tax year Venmo will issue a Form 1099-K to business profile owners who have passed the IRS reporting threshold for their state of residence. For most states the threshold.

TPSOs like PayPal and Venmo. Its important to make sure that your tax information on Venmo matches IRS records so were here to help if you need to change the info on your tax forms. Venmo has some limits on how much you can send in a given week.

The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600. Terminate this user agreement limit your Venmo andor PayPal account andor close or suspend your Venmo andor PayPal account. Increased Tax Reporting on Payment App Transactions.

If the funds being transferred are for goods or a service the new law simply requires businesses to report those funds exceeding 600 rather than the old 20000 limit. PayPal Zelle Venmo Taxes. If you dont have a business profile but frequently use Venmo to sell goods or services we.

The charge is a 175 percent fee with a minimum of 025. If you have not yet completed identity verification you will have. For the 2021 tax year Venmo will.

How these new tax reporting changes may impact you when paying or accepting payments with PayPal and Venmo for goods and services. For the 2021 tax year Venmo will issue a Form 1099-K to business profile owners who have passed the IRS reporting threshold for their state of residence. New Tax Reporting Rules.

In this photo illustration a. Increased Tax Reporting on Payment App Transactions. New Tax Reporting Rules.

Venmo CashApp and other third-party. Read on for more information about these limits. 1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to the.

Starting the 2022 tax. What Your Business Needs To Know. Venmo PayPal and Zelle.

The charge is a 175 percent fee with a minimum of 025. Previously limits surrounding reporting of income received through payment cards and third-party. Venmo PayPal and other payment apps have to tell the IRS about your side hustle if you make more than 600 a year.

Tap on the Me icon in the bottom right corner of the app. A business transaction is. Rather small business owners independent.

Business owners using sites like PayPal or Venmo now face a stricter tax-reporting minimum of 600 a year.

Payment Apps Have New Tax Reporting Requirements For 2022

New Law Impacting Peer To Peer Payment App Users

1099 K Changes What Do They Mean For Your Side Hustle Ramseysolutions Com

Will The Irs Track Every Venmo Transaction Fact Checking Financial Reporting Plans

New Tax Rule Ensure Your Venmo Transactions Aren T Accidentally Taxed

How Will The Irs Treat Your Venmo Payments To And From Your Business Boyer 2 Accountants Inc

What To Know About The Irs New Reporting Requirements For Venmo Paypal And Other Payment Apps

Tax Code Change Affects Mobile Payment App The Hawk Newspaper

Increased Reporting To The Irs Required For Paypal Venmo Third Party Payment Networks Don T Tax Yourself

Venmo Paypal Cash App To Report Business Transactions Of 600 Or More To Irs

How Using Paypal And Venmo Affects Your Taxes As A Freelancer

Stop Sending Money On Venmo There Are Better Alternatives Wired

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

Tas Tax Tip Use Caution When Paying Or Receiving Payments From Friends Or Family Members Using Cash Payment Apps Tas

Samsung Galaxy S22 And S22 Vs Iphone 13 By The Numbers Zdnet

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

What Cash App Users Need To Know About New Tax Form Proposals Verifythis Com

Businesses Accepting Venmo And Other Digital Payments Need To Be Aware Of New Tax Reporting Requirements Anders Cpa

Paypal Venmo Cash App Sellers Must Report Revenue Over 600 Wtsp Com